By Joe Yannetty, screenwriter, comedian, salesperson, and motivational speaker

I’ve put together this three-part series to help make sense of the steps to buying a car at a dealership and specifically, how consumers can learn how to save money on a car purchase. This series is for those who want to get a good deal on a new or used car but without all the hassle. It’s for those car buyers who don’t want to be taken advantage of with typical car salesman tricks and secrets.

In part 1 here, I discussed how to choose your vehicle. In part 2 here, I covered the secrets behind the negotiation.

Here I will discuss how salespeople know that you may let down your guard when you’re trying to get the best car financing rates. That’s where they may use car sales strategies to try and make more money off you. How? From add-ons like anti-theft devices, window tinting, floor mats, splash guards, wheel locks, extended warranties, or multitudes of other items they offer to tack on at the last minute. So read on for those last-minute tricks that happen AFTER you thought you closed the deal.

1. THE CREDIT APPLICATION WILL BE USED AGAINST YOU

One of the biggest car salesperson’s tricks is using a credit application against you. They’ll put pressure on you and say, “We can’t negotiate until we can see that you qualify to buy this car.”

One of the biggest car salesperson’s tricks is using a credit application against you. They’ll put pressure on you and say, “We can’t negotiate until we can see that you qualify to buy this car.”

You can prevent this by checking with your bank first, thus already knowing your best financing terms. Instead of getting intimidated, simply respond, “I qualify to buy this car with a loan at my own bank. I don’t want to do a credit application. I already know what I’m going to pay for this car.”

Without you even knowing it, they may be attempting to control the car deal process by gaining this information from your life that they can use against you. It may have your name, phone number, address, email, banks, credit cards, previous address, occupation, nearest relative, car insurance information, etc.

For example, you may not want to be contacted if you walk away from a potential deal. Even during a pandemic, when in-person deals are being curtailed, there’s still a motivation for car salespeople to call you afterward to try to get you to come back if you didn’t close a car deal. Should you choose to leave, always take the paperwork with you, including any copies they made of your driver’s license.

2. EXAMPLES OF CAR SALES TRICKS FROM USING A CREDIT APPLICATION:

- Let’s say you’re an engineer and you’ve been working at X company for 12 years. The car salespeople know you’re financially stable and they can get you a low rate of financing and then jack it up and charge you more for it.

- If you don’t have good credit, or not enough money to put down, they might say, “What about your sister? Why can’t you borrow money from her?”

- If they see that you own a house, they know that that you probably do have decent credit.

- When you say, “I can’t put down five thousand dollars. All I can do is three.” They might counter with, “Well, you have a MasterCard and Visa. We have your credit limit and balance. You can put five hundred dollars on this credit card and another fifteen hundred on this other one.”

- When they access your insurance information, they’ll know you can buy the car without needing new insurance.

Finally, after viewing cars at multiple dealerships, if you let them all check your credit prematurely, it looks bad and decreases your credit rating. Don’t give any information unnecessarily. Not until you have a satisfactory deal on the total purchase price, out the door.

Another car sales strategy that dealerships use is to try switching you to a lease once you settle on a purchase price (and/or a monthly payment) because the monthly leasing payment appears to be smaller than a monthly purchase payment.

It’s easier for them to make more money off you from a lease than a sale. Unless you like the idea of losing money, do not lease a new car. People lease because they are either too lazy to resell their car, or their ego wants a new car swap every few years. You pay for these conveniences. A lease is essentially a rental contract (plus a huge down payment) leaving you with nothing when it ends, except the option to pay full price for the car if you pay off the residual.

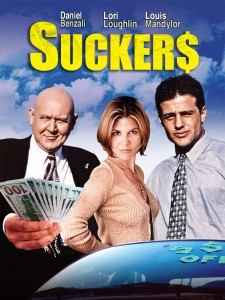

Leasing may be a good deal for you if you can write off all the costs as a business expense. But for the average consumer, leasing is for suckers.

4. DON’T TAKE POSSESSION UNTIL EVERYTHING IS AS YOU WANT IT

4. DON’T TAKE POSSESSION UNTIL EVERYTHING IS AS YOU WANT IT

Get everything in writing and signed. Make sure the dealership is reputable. Read reviews on Yelp. Don’t let them control you. Any time you get a bad feeling, take a step back. Don’t accept promises to fix something tomorrow, or install the new stereo next week. Make sure everything is exactly as you want it, now, before accepting the keys.

As Reggie, the general sales manager in the classic comedy movie SUCKERS says, “If somebody buys a car, and leaves thinking he got screwed, then he’s an idiot. The buyer has ALL the control. He can get up and leave at any time. He does not own that car until he drives it off the lot. Not when he signs the papers—he does not own that car until he TAKES DELIVERY. So, who has control? If he got fucked, he fucked himself.”

As Reggie, the general sales manager in the classic comedy movie SUCKERS says, “If somebody buys a car, and leaves thinking he got screwed, then he’s an idiot. The buyer has ALL the control. He can get up and leave at any time. He does not own that car until he drives it off the lot. Not when he signs the papers—he does not own that car until he TAKES DELIVERY. So, who has control? If he got fucked, he fucked himself.”

To see examples of these classic, powerful, psychological car sales techniques in action, check out Roger Nygard’s funny comedy movie SUCKERS.

Recent Comments